Value-Added Tax (VAT) is a critical component of the UAE’s taxation system, impacting businesses and consumers alike. Understanding the VAT rate, its application, and its implications is essential for compliance and financial planning. This article provides an in-depth look at how much VAT is charged in the UAE, the categories of goods and services it applies to, and the exemptions available.

VAT Rate in the UAE

1. Standard VAT Rate

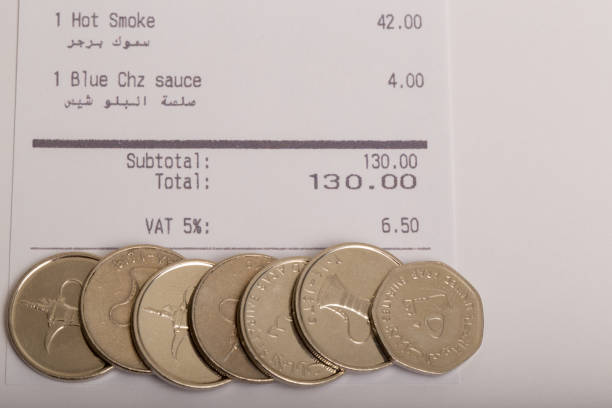

- 5% VAT Rate: The UAE implemented a standard VAT rate of 5% on most goods and services starting January 1, 2018. This rate is relatively low compared to global standards but plays a significant role in the country’s revenue generation.

2. Zero–Rated Supplies

- Zero-Rated VAT: Certain goods and services are subject to a 0% VAT rate. These include specific healthcare services, educational services, and international transportation of passengers and goods. Businesses providing zero-rated supplies can still reclaim VAT on their purchases.

Categories of Goods and Services

1. Taxable Supplies

- Goods and Services: Most goods and services are taxable at the standard 5% VAT rate. This includes consumer products, electronics, food and beverages, and services such as telecommunications and hospitality.

- Commercial Properties: Sales and leases of commercial properties are also subject to VAT.

2. Exempt Supplies

- Financial Services: Certain financial services, such as life insurance and financial intermediation, are exempt from VAT.

- Residential Properties: The sale and lease of residential properties are generally exempt from VAT, with exceptions for the first sale of newly constructed properties.

VAT Compliance for Businesses

1. Registration and Filing

- VAT Registration: Businesses with an annual turnover exceeding AED 375,000 must register for VAT. Voluntary registration is available for businesses with a turnover above AED 187,500.

- VAT Returns: Registered businesses must file VAT returns regularly, typically quarterly, to report their taxable supplies and claim any input tax credits.

2. Record-Keeping and Documentation

- Invoice Requirements: Businesses must issue VAT invoices for taxable supplies, detailing the VAT amount and other required information.

- Record Retention: Proper documentation and record-keeping are essential for VAT compliance. Records must be retained for at least five years.

Implications for Consumers

1. Increased Costs

- Price Impact: The addition of 5% VAT increases the cost of goods and services for consumers. Consumers need to be aware of this when making purchases.

- Transparency: Retailers must display VAT-inclusive prices to ensure transparency for consumers.

2. Exempt and Zero–Rated Goods

- Savings Opportunities: Consumers can benefit from zero-rated goods and services, such as essential healthcare and education, which do not incur additional VAT costs.

Conclusion

The implementation of VAT in the UAE at a standard rate of 5% has significant implications for both businesses and consumers. Understanding the VAT rate, taxable and exempt supplies, and compliance requirements is crucial for navigating the tax landscape effectively. Businesses must ensure proper registration, filing, and record-keeping to stay compliant, while consumers should be aware of the impact of VAT on their purchases.

For expert VAT consultancy services in Dubai, visit AKM Accounting. Our experienced VAT consultants can help you navigate the complexities of VAT regulations, ensuring your business remains compliant and optimized for success. Contact us today to schedule a consultation!