Dubai, known for its luxurious shopping and lifestyle, offers attractive tax refund opportunities, especially for tourists. Understanding how to guide the tax refund in Dubai process can seriously improve your shopping experience, ensuring you get the most value out of your purchases. Whether splurging on high-end electronics, fashion, or unique local artifacts, knowing how to claim your VAT (Value Added Tax) back can lead to substantial savings. This guide will delve into the essential details, providing all the information needed to make the most of Dubai’s tax refund system.

VAT Refund Eligibility in Dubai

What Makes You Eligible for a Tax Refund?

To qualify for a VAT refund in Dubai, shoppers must meet specific criteria set by the UAE’s Federal Tax Authority. The opportunity to claim a tax refund is primarily available to non-resident tourists who are not part of the Gulf Cooperation Council (GCC) countries. Here are the essential conditions that need to be fulfilled to be eligible for a VAT refund:

- Tourist Status: You must be a tourist to the UAE, meaning you are not a resident of any GCC countries.

- Minimum Spend: Each retailer has a minimum spend requirement, typically AED 250. However, this amount can vary, so checking the latest requirements at the point of purchase is advisable.

- Export of Goods: The purchased goods must be exported out of the UAE within a specific timeframe, usually 90 days from the date of purchase.

- Participating Retailers: The purchases must be made from registered businesses in the UAE participating in the ‘Tax Refund for Tourists Scheme.’

Understanding the Types of Eligible Purchases

Not all purchases in Dubai are eligible for a tax refund. Goods consumed or partially used within the UAE, such as food or beverages, do not qualify. Similarly, services are not eligible for VAT refunds. Eligible items typically include tangible goods like electronics, jewelry, watches, apparel, and accessories intended to be taken out of the country. Moreover, retaining all receipts and tax invoices is crucial, as these will be necessary when applying for your VAT refund at designated refund points, such as airports and ports.

By familiarizing yourself with these criteria and planning your purchases accordingly, you can take full advantage of the VAT refund system in Dubai, making your shopping experience even more rewarding and cost-effective.

Dubai Tax Refund for Tourists

How Tourists Can Claim Tax Back

Tourists visiting Dubai have the unique opportunity to claim back the Value Added Tax (VAT) on their purchases, enhancing their shopping experience by making it more cost-effective. The process of claiming a tax refund in Dubai is designed to be straightforward and user-friendly, involving a few key steps from the point of purchase to when you leave the UAE. Here’s a detailed guide on how tourists can reclaim VAT:

Shop at Registered Retailers:

Start by ensuring you shop at stores registered with the UAE’s ‘Tax Refund for Tourists Scheme.’ These stores usually display a prominent ‘Tax-Free’ logo at entrances or windows. Inform the store staff that you intend to claim a tax refund when purchasing.

Request a Tax-Free Tag:

You must request a Tax-Free tag from the retailer at the point of purchase. You will need to provide your passport or GCC national ID to the retailer as they need to enter your details into the system. They will attach a Tax-Free tag to your receipts, which is crucial for claiming the refund later.

Save All Receipts and Documents:

Keep all your receipts and associated Tax-Free tags safe, as you will need them to claim your refund. Organizing these documents is important to ensure a smooth refund process at the point of exit.

Validate Your Purchases:

Before you leave Dubai, you must validate your purchases at one of the Tax Refund Validation points, which can be found at Dubai International Airport and other exit points. Here, you will need to show your purchased items, along with the receipts and your passport. The goods must be unused and in their original packaging.

Claim Your Refund:

Once your items are validated, head to the Tax Refund counter to claim your refund. The refund can be received in various forms, such as credit to your credit card, cash, or mobile wallet. A small administrative fee might be deducted from the refund amount.

Departure:

Complete this process before you check in your luggage, as you may be required to show the goods at the Tax Refund counter. Once the refund is processed, you can proceed to check-in and immigration.

Additional Tips for a Smooth Tax Refund Process

- Ensure the goods remain unused and in original packaging to avoid complications during validation.

- Plan extra time into your airport arrival itinerary to accommodate the tax refund process, as it can take some time during peak travel periods.

- Be aware of the currency in which you will receive your refund, as exchange rates and fees may apply if they differ from your home currency.

Following these steps and tips, tourists can effectively reclaim the VAT paid on their purchases in Dubai, making their shopping experience significantly more rewarding.

How to Claim Tax Back in Dubai

Step-by-Step Guide to the Refund Process

Navigating the Dubai tax refund process can be straightforward with the proper preparation and information. Whether you are a frequent visitor or a first-time tourist, understanding this process can significantly enhance your shopping experience by allowing you to recover the VAT on your eligible purchases. Here’s a detailed step-by-step guide to help ensure your tax refund claim is successful:

Ensure Eligibility:

Before shopping, ensure you are eligible for a VAT refund. As a tourist, you must not be a resident of any GCC country and plan to take the purchased goods out of the UAE within 90 days from the date of purchase.

Shop at Registered Stores:

Only purchases registered at stores under the UAE’s ‘Tax Refund for Tourists Scheme’ qualify for a refund. These stores typically display a ‘Tax-Free Shopping’ logo. Inform the cashier that you intend to claim a tax refund when purchasing.

Obtain Necessary Documentation:

At the point of sale, request the Tax-Free tag and ensure your purchase receipts are adequately documented. The store usually handles this by printing an extra receipt with a barcoded Tax-free tag.

Keep All Receipts and Tags Safe:

Organize and safely store all your receipts and the associated Tax-Free tags, as you will need to present these later in the refund process.

Validate Your Purchases at the Airport:

Upon departure, visit a Tax Refund Validation kiosk before checking in your luggage. At the kiosk, submit your receipts and show the purchased goods and your passport. The goods should be unused and may need to be inspected so they are easily accessible.

Proceed to the Tax Refund Counter:

After validation, proceed to a Tax Refund counter. These are typically located near the airport’s departure area. Here, you can submit your validated receipts for processing.

Choose Your Refund Method:

You can receive your refund via credit card, cash, or even direct transfer to a digital wallet. Some fees may apply, and the refund might not cover the total VAT due to administrative costs.

Final Checks and Departure:

Once your refund is processed, you can check in your luggage and pass through immigration. It’s advised to allow extra time for the refund process, especially during peak travel periods.

Tips for a Smooth Refund Process

- Double-check that each receipt is attached with a Tax-Free tag at the time of purchase.

- Keep your purchases separate and easily accessible for inspection if needed at the airport.

- Be aware of the refund options and associated fees or limits on cash refunds.

By following these steps, you can ensure that your tax refund in Dubai is processed smoothly, allowing you to enjoy more savings from your shopping trips.

ently manage your VAT refund process using the EmaraTax platform, ensuring a seamless experience from submission to correspondence.

Tax Refund Process in UAE

Understanding the Documentation and Timeline

Understanding the documentation and timelines involved can simplify the tax refund process in Dubai. This section provides all the essential details required to streamline your VAT refund process during your visit to the UAE. Knowing what to prepare beforehand and what to expect regarding processing time can significantly enhance your experience and ensure a successful refund claim.

Required Documentation

To ensure a smooth tax refund in Dubai, you need to have the following documents prepared:

- Original Passport: Your passport must prove your tourist status and identity during the purchase and at the refund points.

- Tax-Free Tags and Receipts: When you make a purchase eligible for a tax refund, ensure the retailer provides you with a Tax-Free tag for each receipt. These receipts need a barcode that links to your passport information and purchase details.

- Boarding Pass: Keep your boarding pass handy, as it may be required to verify your departure from the UAE within the stipulated time frame.

- Proof of Payment: It’s beneficial to retain proof of payment (credit card or cash receipt) to correlate with the purchase receipts if verification is required.

Timeline for Processing the Tax Refund

The timeline for receiving your VAT refund in Dubai can vary depending on a few factors, such as the refund method chosen and the time taken for validation. Here is what you can generally expect:

- At the Point of Purchase: Once your purchase is made and the documents are issued, there’s no waiting time involved. You receive your Tax-Free tags immediately.

- Validation at the Airport: Upon departure, you should visit the Tax Refund Validation kiosk before checking your baggage. Validation is quick, usually taking only a few minutes per tourist, provided no discrepancies exist.

- Refund Processing Time: You will proceed to the Tax Refund counter after validation. The actual refund can be instantaneous if you opt for a cash refund (subject to a daily limit) or a credit to a digital wallet. Refunds credited back to a credit card may take a few days to appear on your statement.

Tips for Ensuring a Successful Tax Refund Claim

- Early Preparation: Prepare all documents the night before departure to avoid last-minute hassles.

- Validate Early: To avoid long queues, try to validate your purchases as soon as you arrive at the airport, especially during peak travel times.

- Keep Documents Accessible: When you arrive at the airport, keep your receipts, passport, and other necessary documents in an easily accessible place.

By understanding these essential aspects of the tax refund process in Dubai, you can ensure that your experience is as smooth and efficient as possible. With the proper preparation, you can reclaim a significant amount of the VAT paid, making your shopping experience in Dubai even more enjoyable and economical.

How to Submit a VAT Refund Request Online in the UAE

Submitting a VAT refund request online in the UAE using the EmaraTax portal is straightforward. Follow this detailed guide to apply for your VAT refund efficiently:

Log into EmaraTax

- Access the EmaraTax portal by entering your login credentials or using UAE Pass.

- If you’re a new user, register by selecting the signup option.

- Once logged in, you will be directed to the User Dashboard.

Initiate a VAT Refund Request

Select your user type on the dashboard as ‘Taxable Person’ and click Proceed. Then, select the appropriate options for tax agents, tax agencies, and special refunds.

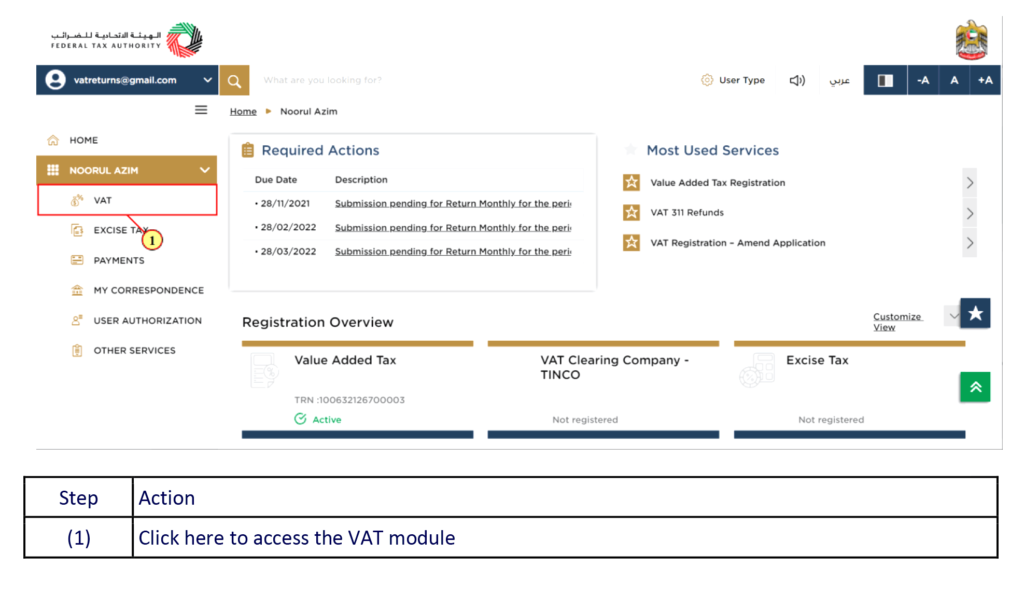

Navigate to the VAT Module in the left sidebar.

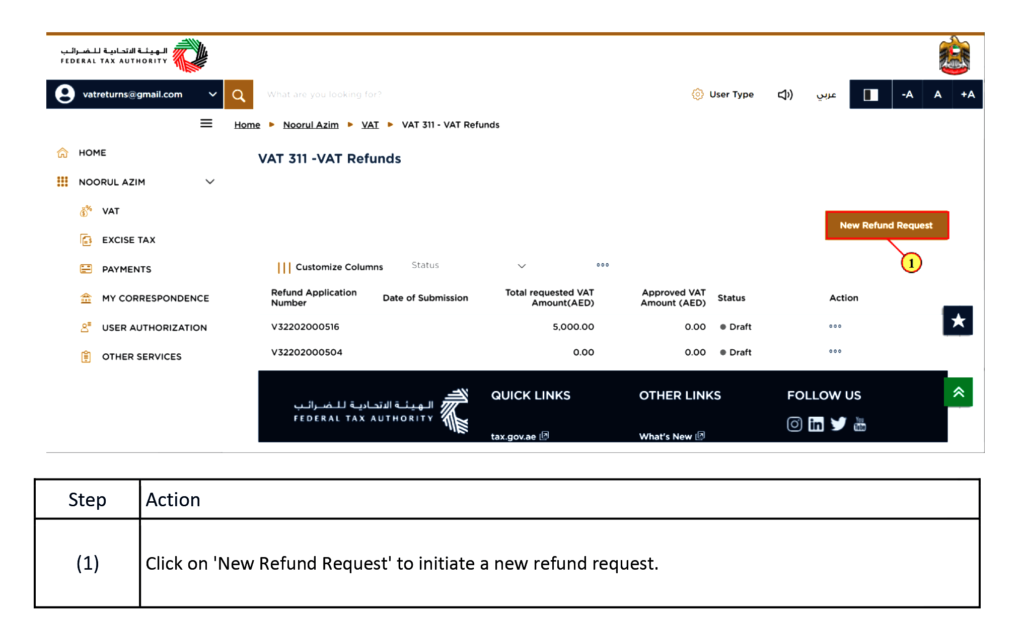

Click on ‘New Refund Request’. Here, you can also view and manage previous requests.

Follow the prompts to confirm you understand the guidelines, then click ‘Start’ to begin the refund process.

Complete the VAT Refund Form

Verify your bank details to ensure accurate refund processing.

Input the refund amount, which should not exceed the “Excess Refundable VAT Amount.”

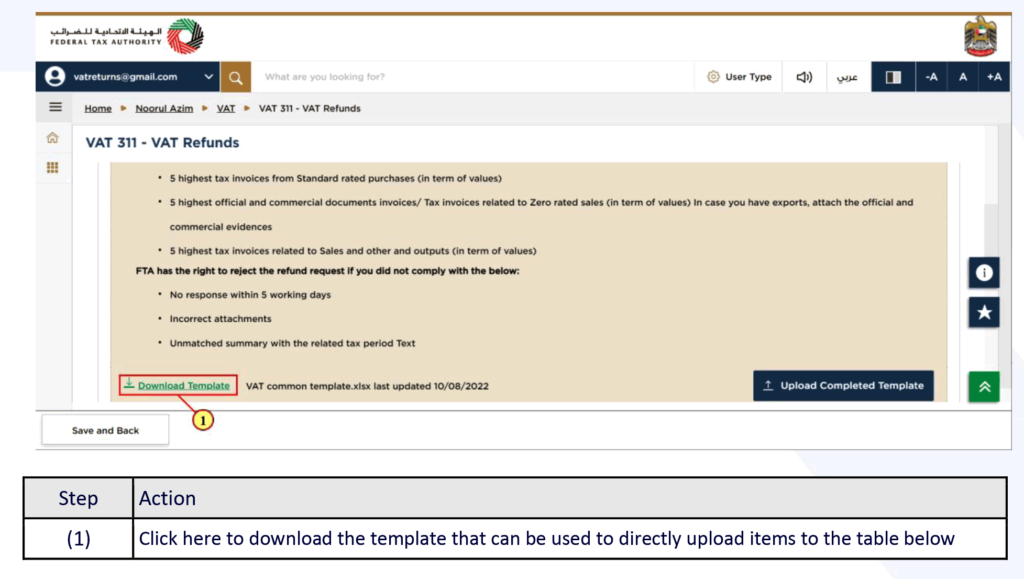

To add supporting details, click ‘Add Supporting Details’ and use the ‘Download Template’ button to complete and upload the required template.

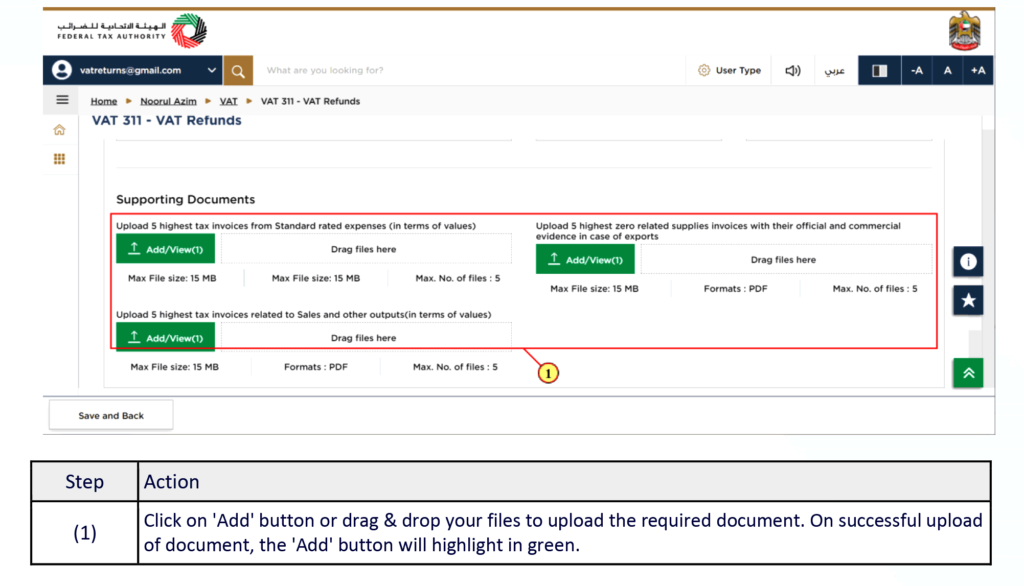

Click the edit button to provide additional information, such as contact details and VAT supplies, and attach necessary documents. Upon successful upload, a green indicator will appear.

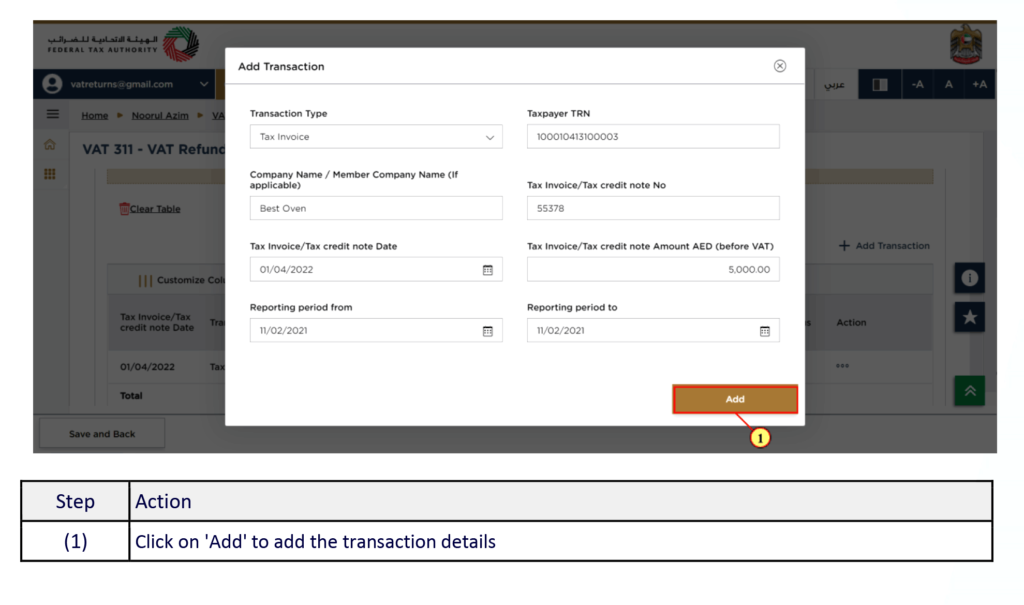

Add transaction details by clicking ‘Add Transaction’ and confirm each entry.

Navigate through each section of your application to review it. Save your progress with ‘Save and Back,’ and proceed with ‘Next’ to finalize.

Confirm agreement to the terms and conditions by marking the checkbox and submitting your application by clicking the ‘Submit’ button. Note the application number for your records.

Correspondence and Notifications

After submitting your refund request, you will receive notifications, including submission acknowledgment, approval, or rejection of your refund request.

The correspondence section of EmaraTax contains all correspondence, including the ability to download acknowledgments and VAT certificates.

Following these steps, you can efficiently manage your VAT refund process using the EmaraTax platform, ensuring a seamless experience from submission to correspondence.

Documents Required for Tax Refund in Dubai

Prepare These Documents Beforehand

To ensure a smooth tax refund in the Dubai process, it is crucial to prepare and organize all necessary documents before you approach the refund counter. Having the proper documents ready speeds up the process and minimizes the chances of complications. Here’s a comprehensive list of all the documentation you will need to claim your tax refund in Dubai efficiently:

- Valid Passport: Your passport is the primary document required for any tax refund process in Dubai. It serves as your identification and proves your eligibility as a non-resident tourist under the tax refund scheme.

- Fully Completed Tax-Free Forms: When you purchase, the retailer should provide you with a Tax-Free form for each transaction. Make sure these forms are filled out completely and attached to the receipts.

- Original Purchase Receipts: Keep all original receipts of your purchases. Each receipt should be linked to a Tax-Free form provided by the retailer. Ensure these receipts are in good condition and must be scanned during the refund process.

- Proof of Payment: Whether you paid by cash, credit, or debit card, having evidence of payment can be helpful, especially if there are any discrepancies or queries from tax refund officials.

- Boarding Pass: Your boarding pass is required to prove that you are leaving the UAE, thus completing the conditions for a VAT refund. It may also be checked to verify your departure date and destination.

- Goods Purchased: You must present the items for which you claim a tax refund and the receipts. They must also be unused and in their original packaging to qualify for the rebate.

Additional Tips for Document Management

- Keep Copies: It’s a good idea to keep copies of your receipts and Tax-Free forms in case the originals are lost or misplaced.

- Organize Documents: Use a document organizer or a specific folder to keep all your tax refund-related documents together. This will save you time at the airport and help ensure you have all the necessary documents when approaching the tax refund counter.

- Check for Accuracy: Before leaving the store, verify that all tax-free forms and receipts information is correct and legible. Any errors or omissions could delay or invalidate your refund claim.

By preparing these documents beforehand and keeping them organized, you can ensure that your tax refund in Dubai experience is as seamless and successful as possible. Proper preparation is the key to a hassle-free refund process, allowing you to enjoy the financial benefits of shopping in Dubai without unnecessary stress.

FAQ about Tax Refund in Dubai

What minimum spend is required to qualify for a VAT refund in Dubai?

To qualify for a VAT refund in Dubai, each receipt must total AED 250. This threshold applies to the total purchase amount on a single receipt, including VAT.

Can I claim a tax refund on services, or is it just for goods?

In Dubai, the tax refund scheme applies only to goods tourists intend to take out of the country. Services, including hotel accommodations, car rentals, and dining, are not eligible for a VAT refund under this scheme.

Are there any items that are excluded from tax refunds in Dubai?

Yes, there are specific exclusions in the tax refund scheme. Items that are not eligible for a VAT refund include:

- Goods, such as food and beverages, are consumed or partly used in the UAE.

- Motor vehicles, boats, and aircraft.

- Goods that are not accompanied out of the UAE.

- A freight forwarder exports goods.

What should I do if my tax refund application is denied?

If your tax refund application is denied, you should first inquire about the reason for the denial at the refund counter. Typical reasons include missing documentation or discrepancies in the information provided. You may reapply immediately if the issue can be resolved on the spot, such as by giving missing documents. You can contact the tax refund service provider for detailed instructions and assistance if further review is needed.

Where are the tax refund counters located in Dubai?

Tax refund counters in Dubai are primarily located at Dubai International Airport, both at Terminal 1 and Terminal 3. They can be found after immigration, near the departure areas. Tax refund services are also available at other exit points like seaports and the Al Maktoum International Airport.

Conclusion

Navigating the tax refund in Dubai process can significantly enhance your shopping experience, allowing you to reclaim a substantial amount of the VAT paid on eligible purchases. You can efficiently claim your tax refund by understanding the eligibility criteria, preparing the necessary documents, and following the correct procedures. This makes your visit to Dubai even more rewarding as you enjoy the benefits of cost-effective shopping in one of the world’s most luxurious shopping destinations. Planning and keeping informed about the latest regulations and procedures can ensure a smooth and beneficial tax refund experience during your stay in the UAE.